MLCC industry in-depth report: Passive components subdivide the golden track, the rise of domestic manufacturers is imminent

(Report Producer/Author: Huachuang Securities, Geng Chen, Xiong Yiyu)

Report Summary

MLCC (Chip Multilayer Ceramic Capacitors) accounts for about one-third of the passive component market, and the global market scale exceeds tens of billions of dollars. Thanks to the characteristics of high pressure resistance, small size, long life, and wide capacitance range, it is currently widely used in consumer electronics, industry, communications, automobiles and military industries, and is known as the electronics industry rice.

The 5G new energy technology revolution drives the development of MLCC in the direction of miniaturization and high capacitance. MLCC is widely used in downstream electronic terminals. With the explosion of the 5G application layer, electronic terminals are becoming smaller and more sophisticated, and MLCC is developing in the direction of miniaturization and high capacitance. Due to the addition of more functions in 5G mobile phones, it is estimated that MLCC stand-alone usage will grow by about 50%. The increase in the penetration rate of electric vehicles is also accelerating the penetration of automotive electronics, and the value of automotive-grade MLCC has increased by 3-5 times. The consumer electronics and automotive sectors are expected to usher in structural growth opportunities.

The competitive landscape of the industry is stable and changing, and domestic manufacturers are struggling to catch up. Currently, the supply of MLCC is dominated by Japanese/South Korean/Taiwanese manufacturers. CR8 accounts for about 90% of the market. Among them, Murata and Samsung Electro-Mechanics are represented by Japan and South Korea occupying the mid-to-high-end market, while Taiwanese have a higher share of the mid-to-low-end market. As Japanese manufacturers such as Murata withdrew from the mid- and low-end market quarterly in 2016, Taiwanese manufacturers such as Yageo accelerated industry integration to occupy a major share of the mid- and low-end market. Although the overall market share of mainland manufacturers is relatively low, with the support of end customers, they will increase production and actively meet the huge market of domestic substitutes. At present, the domestic leading manufacturers have expanded their production capacity several times, and the technological gap between their products and Taiwanese manufacturers has been greatly reduced. From the perspective of 3-5 years, domestic manufacturers have the opportunity to surpass Taiwanese manufacturers and become the second echelon.

Supply and demand move towards a tight balance, and MLCC prices may usher in a new round of rising cycle. After two years of digestion in 19-20, MLCC prices have stabilized since the top adjustment in 18 years. In 20 years, due to the impact of overseas epidemics, factories in Malaysia, Singapore, Japan and other places have repeatedly stopped production. Stimulated by the housing economy and the global economy after the epidemic, terminal consumption has recovered strongly, the penetration rate of 5G mobile phones has increased rapidly, and new energy has ushered in explosive growth. The supply and demand situation has changed from loose to tight. The representative Taiwanese giants at the end of December The capacity utilization rate is close to 90%. There is no large amount of new capacity in the short-term industry. Demand continues to be strong. Under the distribution system, prices are expected to enter a new round of rising cycle.

1. MLCC: Passive components subdivide the golden track

(1) MLCC is widely used and the market space exceeds 10 billion U.S. dollars

1. The market for passive components is huge, with capacitance accounting for more than 70% of passive components. Passive components are also known as passive components, which refer to electronic components that do not generate any form of power during operation. From the perspective of the nature of the circuit, passive components have two basic characteristics: 1. They do not consume electric energy by themselves, or convert electric energy into other forms of energy; 2. They only need to input a signal and can work normally without an external power supply. Common passive components mainly include capacitors (C), resistors (R), inductors (L), transformers, connectors, circuit boards, sockets, etc.

According to ECIA data, global sales of capacitors, inductors, and resistors totaled approximately US$27.7 billion in 2019, a year-on-year decrease of 13.7%; total shipments were approximately 5.4 trillion units, a year-on-year decrease of 27.7%. Capacitors, as one of the three core passive components, are mainly used to store electricity and electric energy. They can play the role of charge storage, AC filtering or bypassing, cutting or blocking DC voltage, and providing tuning and oscillation in the circuit. The proportion is up to 73.3%.

2. Ceramics occupy the mainstream of the market, and MLCC is developing rapidly

There are many types of capacitors, and there are many classification standards. According to the shape, it can be divided into plug-in capacitors and chip capacitors; according to polarity, it can be divided into polar capacitors and non-polar capacitors; according to the type of medium, it can be divided into ceramic capacitors, aluminum electrolytic capacitors, tantalum electrolytic capacitors and polyester film capacitance.

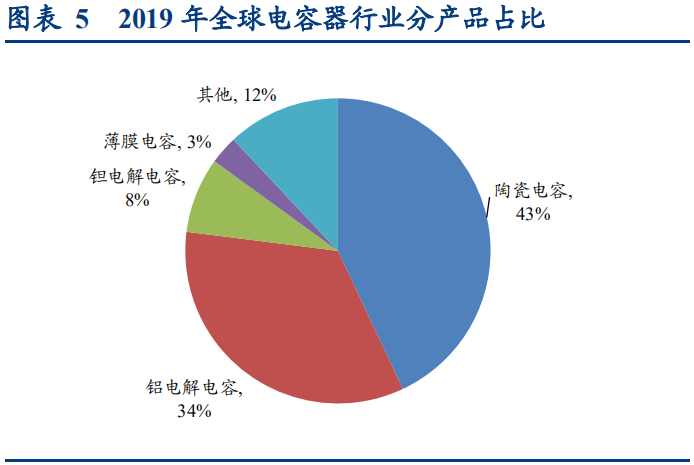

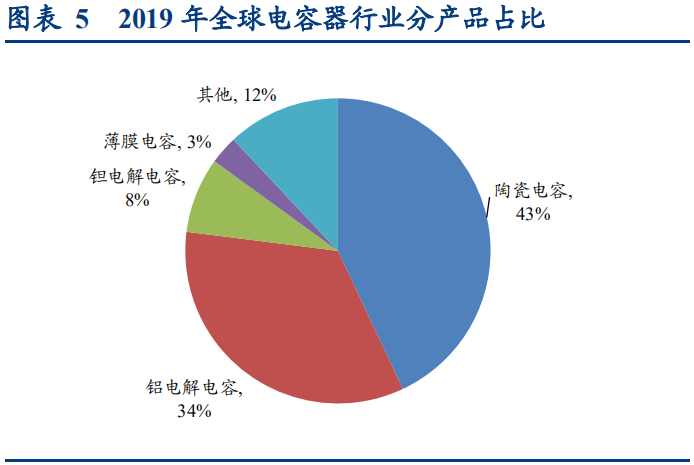

Compared with other capacitors, ceramic capacitors have the advantages of small size, large voltage range, and relatively low price. Under the trend of miniaturization, there is a huge demand for small-volume ceramic capacitors. According to data from the Huajing Industry Research Institute, the market share of ceramic capacitors in 2019 will reach up to 43%. Among them, ceramic capacitors can be divided into three categories: single-layer ceramic capacitors, leaded multilayer ceramic capacitors and chip multilayer ceramic capacitors (MLCC). MLCC has the advantages of small size, high specific volume, high precision, etc. It can be mounted on PCBs, hybrid integrated circuit substrates, etc., conforming to the trend of miniaturization and light weight of consumer electronics, and has become the main force of ceramic capacitors, accounting for more than 90%.

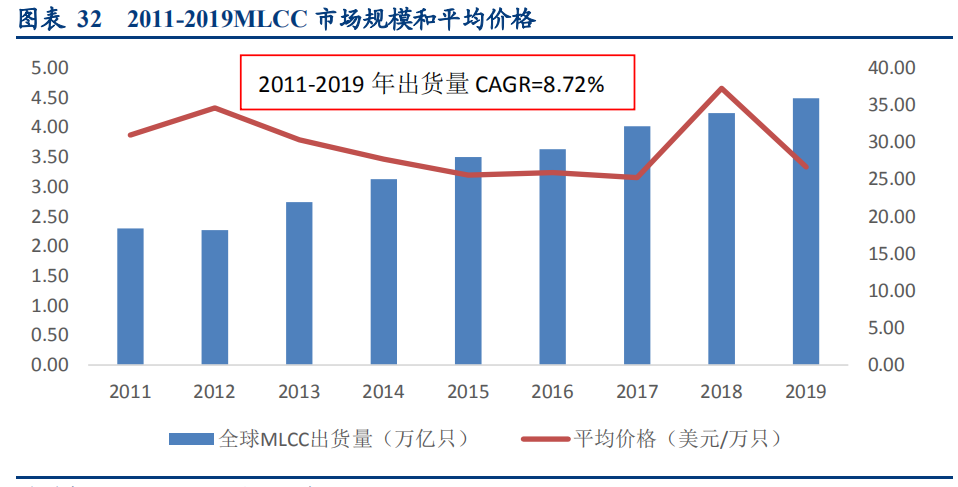

With the gradual increase in downstream demand, especially driven by the demand for high-value MLCCs such as automotive electronics, the global MLCC market has accelerated its growth. According to data from the Electronic Components Industry Association and Paumanok, the global MLCC market size has increased significantly in 2018, affected by price increases, and has maintained steady growth in other years. The market size in 2019 was close to US$12 billion and shipments reached 4.49. Trillions. In the future, as the penetration rate of downstream 5G and automotive electronics gradually increases, the MLCC market scale is expected to maintain a rapid growth of about 10%.

MLCC has many classifications, and generally there are three classification standards: 1. According to the ceramic medium used by MLCC, it can be divided into Class 1 and Class 2. Class 1 has extremely high stability, and Class 2 has a high volume ratio. Capacity; 2. According to temperature characteristics, material, production process, and filling medium, it can be divided into COG, NPO, X7R, Z5U, Y5V, etc.; 3. According to material SIZE package size, it can be divided into 0402, 0201, 01005, etc.

3. Terminals promote the development of MLCC to "five highs and one small" As downstream electronic products gradually develop in the direction of lighter and thinner, superimposed on the increase in the proportion of automotive electronics, promote the development of MLCC in the direction of "five highs and one small". Among them, 1. Miniaturization refers to the development of electronic products in the direction of miniaturization, leading to a gradual increase in the proportion of small-size MLCCs such as 0201 and 01005; 2. High-capacity: refers to the advantages of MLCCs with stable electrical performance, non-polarity, and high reliability. Driven by the trend of replacing lithium electrolytic capacitors, new materials and processing technologies for capacitors are being promoted towards higher capacity; 3. High frequency and high temperature resistance: The working frequency of MLCC has entered the millimeter wave frequency range. The maximum working temperature of commonly used MLCC is 125℃, which meets the extreme working environment of special electronic equipment. The working temperature of MLCC has gradually increased to 260℃; 4. High reliability: military and civilian power systems, including ground power, power systems and other power supply systems, satellites Systems such as radar and radar, as well as the development of new power semiconductors, require highly reliable MLCCs that can withstand high voltages and high currents.

(2) The MLCC market is highly concentrated and has strong profitability

1. The upstream ceramic powder has a high concentration, and the downstream is widely used

The MLCC industry chain can be divided into upstream materials, midstream device manufacturing and downstream applications. The upstream materials are mainly ceramic powder and electrode materials. The production of ceramic powder requires barium titanate, strontium zirconate, and barium zirconate titanate. Manufacturers include Murata, Sakai, Ferro, National Ceramics, Sanhuan Group, etc. , The concentration is extremely high; copper, silver, palladium and other materials are generally used to make the inner and outer electrodes of the electric plate metal, which are mainly produced by mainland manufacturers. MLCC has a wide range of downstream applications, which can be divided into military, industrial, consumer, etc. According to Tech Design data, consumer electronics accounted for 64.2% in 2019, and automotive electronics accounted for 14%.

From a cost perspective, the cost of MLCC is mainly composed of raw materials, packaging materials, labor and equipment depreciation, among which raw materials account for the highest proportion, which accounts for 20-25% of low-capacity MLCCs and high-capacity MLCCs. It is as high as 35-45%, which is very important to the performance of MLCC. Therefore, for MLCC companies, the self-supply of ceramic powder will significantly affect the gross profit margin of their products.

The preparation methods of ceramic powder are diverse, and the hydrothermal method has gradually become the mainstream of the industry. At present, ceramic powder is formed by adding modifiers on the basis of barium titanate. The main production methods of high-purity barium titanate include solid phase method, oxalic acid co-precipitation method, and hydrothermal synthesis method. The solid phase method refers to ball milling, mixing, filtering and drying equal moles of high-purity barium carbonate and titanium dioxide, and then calcining at 1050-1150°C. The co-precipitation method is to mix equimolar Ba2+ and Ti4+, under partial alkali conditions, add precipitating agent, filter, wash, dry, and calcinate to obtain barium titanate powder. The hydrothermal method refers to putting the precursor containing barium and titanium into a hydrothermal kettle and reacting for a period of time under high temperature and high pressure conditions to obtain the final product. The hydrothermal method has become the mainstream of the industry due to its high purity and small particle size.

The concentration of ceramic powder material suppliers is relatively high. Because ceramic powder has high requirements for purity, particle size and uniformity, related technologies and processes have high thresholds, resulting in an oligopolistic competition pattern for MLCC ceramic powder suppliers. Among them, Murata's ceramic powder is for personal use only, Sakai, Japan is the first company in the world to master the hydrothermal method of producing ceramic powder, and National Ceramic Materials is the second company in the world to master the hydrothermal process, and the products are more cost-effective. In the field of low-end MLCC ceramic powders, it has gradually realized localized substitution. Sanhuan Group has mastered the formulation and preparation technology of anti-reduction ceramics and electronic pastes, which greatly improved its competitiveness in the MLCC field.

2. Midstream MLCC oligopoly and stable competition

Currently, there are more than 20 MLCC manufacturers in the world. Among them, Japanese companies such as Murata and TDK have strong advantages and are in the first echelon; companies in the United States, South Korea, and Taiwan, such as Samsung Electro-Mechanics, KEMET, AVX, and Yageo, are in the second echelon; Mainland companies such as Fenghua Hi-Tech and Sanhuan Group , Yuyang Technology, and Torch Electronics are in the third echelon due to their late start. According to ECIA data, Murata, Samsung Electro-Mechanics and Taiyo Yuden, the top three in MLCC revenue in 2019, have a combined market share of 71%, showing an oligopoly pattern. Domestic companies such as Fenghua Hi-Tech MLCC have revenue of only 990 million yuan, with a global market share of 1.1%, and there is huge room for domestic substitution.

3. The MLCC industry has high gross profit margins, good cash flow, and high-quality track attributes

MLCC is an industry where structural growth and cyclical fluctuations coexist, and its profitability will show a certain degree of volatility. Even in a downturn in the industry, its gross profit margin is still as high as 40% or more, demonstrating that the industry is good Profitability. Take China Taiwan’s Yageo (because MLCC accounts for a relatively high proportion of its MLCC gross profit margin) and Fenghua Hi-Tech as examples. In 2018, affected by the price increase, both gross profit margins were as high as 60% or more, and then the industry entered the destocking stage. , The gross profit margin in 2019 fell to about 35%, and stabilized and rose to more than 40% in 2020H1, which is much higher than the average gross profit margin of the SW electronics industry. In addition, by selecting Taiwanese MLCC manufacturers Yageo and Huaxinke, after a comparative analysis of their ROE, it is found that the profitability of the above-mentioned companies is also much higher than the average level of the SW electronics industry, which further confirms the good profitability of the industry.

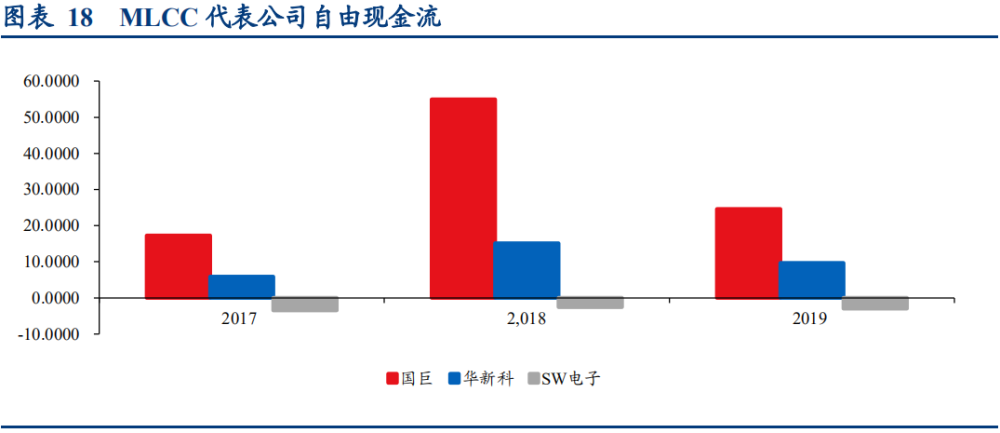

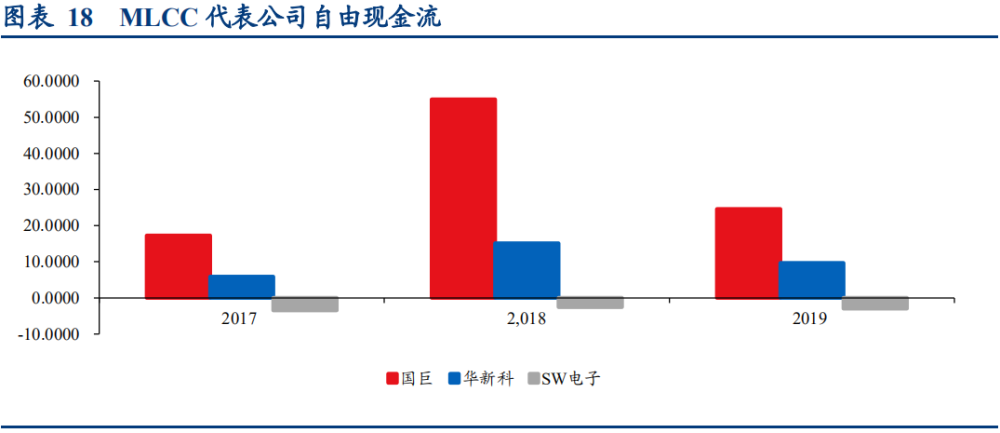

Due to the high proportion of fixed assets in the electronics industry and the need to continue to invest in capital expenditures, corporate cash flow pressure is relatively high, which directly leads to poor corporate free cash flow data. We selected the free cash flow data of Taiwan's MLCC company Yageo and Huaxinke in the past three years and compared it with the SW electronics industry. We found that the free cash flow of the above companies has been positive when the industry fluctuates greatly in the past three years, indicating MLCC Good cash flow in the industry, this feature will enable the company to have better anti-risk capabilities and survivability.

2. Technological innovation drives the structural growth of demand

(1) Consumer electronics continue to innovate, and the amount of MLCC stand-alone is increasing rapidly

As the penetration rate of new applications such as multi-camera, wireless charging, and under-screen fingerprint recognition increases, consumer electronics products need more components to stabilize voltage, stabilize current, and filter clutter to ensure the normal operation of terminal equipment. Faster connections and more powerful processing capabilities require more passive components. The continuous innovation of mobile phones has also brought a rapid increase in the amount of passive components such as MLCC. Taking the iPhone as an example, the MLCC usage has increased from 177 in the original iPhone to 1,100 in the iPhone X, and the iPhone 11 usage is expected to be close to 1,200. In addition, as the proportion of domestic manufacturers such as Xiaomi, OPPO, vivo and other high-end devices continues to increase, the consumption of MLCC is also expected to increase.

(2) The increase in automotive electronics rate and the popularization of new energy vehicles have doubled the demand for MLCC

Automotive electronics is the collective term for vehicle body electronic control devices and vehicle electronic control devices, which mainly include engine control systems, chassis control systems, body electronic control systems, safety and comfort systems, automatic driving systems, infotainment, and networked systems. According to data from China Industry Information Network, the proportion of automotive electronics costs in normal costs is increasing year by year, and is expected to reach 50% in 2030. With the increase in automotive electronics, the use of single-vehicle MLCCs is expected to increase from the previous 1000-3000 to 3000 -6000 pcs. As governments of various countries pay attention to global warming, which has promoted the transformation of traditional vehicles to new energy vehicles, and the continuous improvement of new energy vehicle technology, the global sales of new energy vehicles have gradually increased. According to the data of "Global EV Outlook 2020", the global sales of new energy vehicles increased rapidly from 8,200 in 2010 to 2.1117 million in 2019. In addition, Bloomberg predicted in the “Long-term Electric Vehicle Outlook” in 2019 that the global penetration rate of pure electric passenger vehicles in 2025 will reach 58%. Due to the increase in control of electric vehicles, the average number of MLCCs used continues to increase as the electrification rate increases. According to Murata's forecast, compared with traditional fuel vehicles, MLCC consumption has increased 4.1 times in hybrid electric vehicles/plug-in hybrid electric vehicles and 5.2 times in pure electric vehicles. Therefore, the automotive demand for passive components represented by MLCC will continue to expand as the penetration rate of electric vehicles increases.

(3) 5G is approaching, MLCC opens up new space for growth

5G base stations are the core equipment of 5G networks, which mainly provide wireless coverage and realize wireless signal transmission between wired communication networks and wireless terminals. As 5G base stations have the characteristics of high accuracy and small coverage radius, the number of 5G macro base stations required for the same signal coverage area is far more than the number of 4G macro base stations. According to data from the Foresight Industry Research Institute, 130,000 domestic 5G base stations have been built in 2019 and will rapidly increase to 8.16 million in 2025. In order to meet the ultra-high user experience rate requirements in the 5G era, and achieve the ultimate information transmission speed and extremely high information transmission quality, the massive antenna array technology (MIMO) emerged at the historic moment, resulting in an increase in the consumption of single-base station MLCC. Under the influence of the above factors, the consumption of MLCC in communication base stations has increased significantly. According to TaiyoYuden's official website, the scale of global communication base station MLCC demand in 2023 will reach 2.1 times that of 2019.

Three, high barriers, excellent structure, domestically produced speed up catching up

(1) The manufacturing process is complicated and customer certification is difficult, creating double barriers in the industry

1. MLCC manufacturing process tends to be complex, creating technical barriers. At present, MLCC manufacturing processes mainly include dry casting process, wet printing process, and porcelain glue transfer film process. Among them, the dry casting process is a production process commonly used by manufacturers due to its simple equipment and high production efficiency. However, with the market's increasing demand for products and high-end MLCC, the wet printing process and the ceramic glue transfer film process have gradually become the development trend of high-level ceramic capacitor manufacturing technology.

1) Dry casting process: A production process commonly adopted in China. It mixes ceramic powder with binders, plasticizers, solvents and dispersants into a slurry with good suspending properties. Under the action of the doctor blade, a continuous and uniform slurry layer is cast on the base tape. Under the action of surface tension, the slurry layer forms a smooth natural surface. After drying, it forms a soft leather-like film tape. After printing electrodes, lamination, punching, debonding, and sintering, capacitor chips are formed.

2) Wet printing process: The ceramic dielectric slurry is screen-printed into a ceramic film as the dielectric of the multilayer ceramic capacitor. The metal electrode and the upper and lower protective sheets are formed by screen printing, that is, press the "lower protective sheet-electrode-" Medium-electrode-medium...-upper protection sheet" is printed sequentially to achieve the number of layers designed. After finishing the above process, drying is carried out, and then cut into chips according to the size requirements of the chip capacitors.

3) Porcelain glue film transfer process: take the roll film as the carrier, and use special slurry extrusion equipment to evenly squeeze the ceramic slurry on the carrier to obtain a continuous roll of ceramic dielectric layer with precise film thickness. It is below 2μm, which realizes the ultra-thin manufacturing of the dielectric layer. When manufacturing capacitors, ceramic dielectric coils are used as the basis, and the ceramic paste layer is overprinted after printing metal electrodes on them.

The main technical barriers to MLCC manufacturing are: 1. The quality of ceramic powder significantly affects the number of layers and capacitance of MLCC. Taking X7R as an example, its manufacturing principle is based on the modification of nano-scale barium titanate to obtain the product. At present, Japanese manufacturers mostly modify the barium titanate of about 100 nanometers to obtain small-sized and high-capacity MLCCs. In China, they modify the barium titanate of more than 300 nanometers, and there is still a certain gap; 2. Layer printing technology to enable small-size MLCC with large capacity. At present, Japanese manufacturers have stacked 1000 layers on 2 micron thin film media to produce MLCCs with a single-layer dielectric thickness of 1 micron and a capacitance of 100 microvolts, while domestic Fenghua Hi-Tech can only stack 300 on 3 micron thin film media. -500 layers, there is a big gap between the material side and the technology side; 3. Co-firing technology. Since the MLCC is composed of a ceramic body, an inner electrode metal layer and an outer electrode metal, it is necessary to consider problems such as no delamination or cracking between the ceramic medium and the inner electrode metal during the manufacturing process.

2. Low BOM ratio and long certification time, creating barriers to customers

With the continuous innovation of MLCC downstream products such as mobile phones, the consumption of MLCC has increased significantly, but its cost ratio is still very low. According to data from the Industry Information Network, the MLCC consumption of 4G mobile phones is generally around 700, and that of 5G mobile phones is around 1,000. Taking iPhone12 as an example, the price of a single mobile phone MLCC is around 10-20 yuan, which is less than 1% compared to a BOM above 2,000 yuan. Customers are less sensitive to their prices, and they value whether their product parameters are more important. Meet the corresponding requirements. In addition, compared to the consumer electronics industry, the automotive and military industries have higher requirements for product performance and stability. For suppliers that have passed the verification, downstream customers tend to cooperate closely with them for a long time to reduce the risk of replacing suppliers.

(2) The self-sufficiency rate is extremely low, the importance is urgent, and the domestic substitution space is large

With the rise of China's independent mobile phone brands such as Huawei and Xiaomi, and the superposition of my country's global leadership in 5G base station construction, the domestic demand for MLCC continues to increase. At present, the domestic MLCC market accounts for about 70% of the global market. According to the annual report of Sanhuan Group, the amount of imported MLCC in my country in 2019 was as high as 46.64 billion yuan, and the number of imports was 2.78 trillion. Compared with the domestic MLCC leader Fenghua Hi-Tech’s 990 million yuan revenue in chip capacitors during the same period, there is huge domestic substitute space. .

(3) Japan and South Korea are shifting to high-end products, and the mainland is speeding up to catch up with Taiwan

At the end of 2016, major Japanese and Korean manufacturers have successively adjusted their production capacity. For example, in March 2018, Murata announced the suspension of production of some 0402, 0603, 0805 and other products and the shift to high value-added MLCCs such as industrial control and automobiles, resulting in the structural appearance of general-purpose MLCCs. With insufficient production capacity, domestic manufacturers have ushered in a good opportunity for expansion. Among them, Fenghua Hi-Tech conducted a non-public offering in January 2021 to raise funds of no more than 5 billion yuan, of which 4 billion yuan was invested in the construction of high-end capacitor bases in Xianghe Industrial Park. When the project reaches production capacity in 2024, the new high-end MLCC production capacity will be 45 billion yuan/month, and the total production capacity is expected to reach 60 billion yuan/month; Sanhuan Group will also conduct a non-public issuance in 2020 to raise a total of no more than 2.175 billion yuan, of which 1.895 billion yuan It is used in the technical transformation project for the expansion of the production of high-quality multilayer chip ceramic capacitors for 5G communications, and plans to increase the production capacity by 20 billion units/month; Yuyang Technology will be held in the economic development zone of Chuzhou City, Anhui Province on the morning of December 16, 2020 The groundbreaking ceremony for the MLCC project with an annual output of 500 billion pieces

4. Supply and demand are tightly balanced, and the price increase cycle may start

(1) Medium-cycle demand growth potential is large, and supply elasticity is small

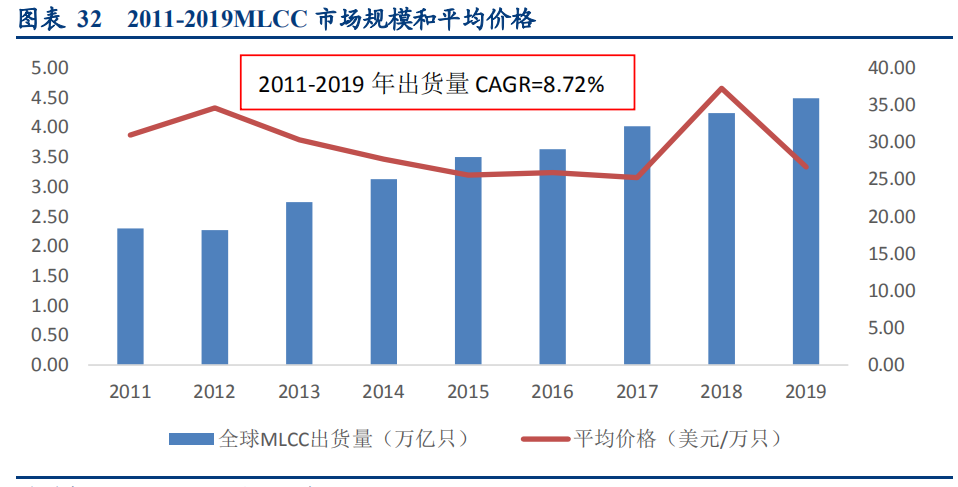

MLCC has strong bulk properties, and changes in supply and demand have caused prices to fluctuate drastically. In the past ten years, MLCC has experienced two cycles of price increase cycles, with prices increasing in 11-12 and 17-18 respectively. Just look at the shipment volume and the industry demand is increasing every year, mainly because the penetration rate of electronic products continues to increase, technological innovation never stops, and the boundaries of application fields continue to expand. As a general-purpose component, the sustainable growth of demand is determined by MLCC. The industry trend of Hexin Energy will accelerate the growth of industry demand in the next 3-5 years.

5G mobile phones/base stations and electric vehicles have a strong five-year growth certainty. In consumer electronics, smartphones account for about 2/3. 4G standard high-end mobile phones require 550-900 MLCCs, and 5G standard mobile phones require 650-1500. In 2025, based on a 100% penetration rate of 5G mobile phones and an average usage increase of 50%, other pan-consumer electronics such as IOT consider total capacity expansion and product iteration, and the overall growth rate will be faster than that of smartphones. The overall growth rate of consumer electronics is expected to exceed 50%. The trend of vehicle electrification: On average, each pure electric vehicle needs 10,000 units, which is 3-5 times more than the 3000~3700 ordinary fuel vehicles. Calculated by 2025 50% penetration rate and 400% bicycle, the demand for automotive electronics will increase by more than 200%. 5G base stations: The current global 5G base station construction has reached the mid-range, the domestic base station construction growth rate is slowing down, and there is still a large amount of construction demand overseas. It is conservatively estimated that the total base station side will increase by 10% by 2025. It is conservatively estimated that the global 5-year CAGR has increased by more than 10%, which is significantly higher than the compound growth rate of 8% in the past.

From the supply side, the current global static annual production capacity is about 5.8 trillion pieces. According to the demand in 19 years and the growth rate from 20-21, the demand in 21 years is expected to reach 5.5 trillion pieces. Supply and demand are in a tight balance. Actually considering the impact of the epidemic Part of the production capacity, the actual supply and demand situation is tight.

From the perspective of capacity growth, the head manufacturers represented by the Japanese are low in their willingness to expand production, and the annual expansion is low, and the Japanese production capacity is shifting to automotive electronics. Automobiles are mainly 0603 models, occupying the equivalent 0201, 0402 production line The production capacity is more than twice, considering the actual expansion, the effective supply growth is limited. Domestic manufacturers can see with certainty that Fenghua and Sanhuan will produce about 700 billion new capacity in three years. Considering capacity construction and climbing, the actual contribution of incremental capacity will be less, and supply and demand will continue to be maintained in 3-5 years. The situation is tight.

(2) MLCC cycle review

The last round of the business cycle was 2017-2018. The prices of some models increased several times, driving the profits of some manufacturers to increase by several times.

Increased demand for medium and high-voltage products for industrial/automotive use, and Japanese manufacturers shifted part of their conventional production capacity to automotive use, resulting in a shortage of both automotive and conventional products. Medium and high voltage products are mainly used in the automotive and industrial fields. With the increase in automotive electronics and new energy vehicles, the demand for automotive passive components increases, and automotive products have higher profit margins, Murata and other manufacturers will transfer some of their production capacity When it comes to automotive use, the supply of conventional products is insufficient, while the demand for medium and high-pressure products for automotive applications is in short supply.

Passive components for vehicles will usher in rapid growth. Taking MLCC as an example, the consumption of new energy vehicles will double, and the consumption of pure electric vehicles MLCC will be 5.2 times that of fuel vehicles. With the increase in the rate of automotive electronics, the use of MLCC bicycles is expected to double in two years. In addition, automotive MLCCs will enjoy higher prices and profits. According to research, the price of automotive MLCCs is about 5-10 times that of traditional consumer electronics MLCCs. Due to the higher value of automotive products, Murata, TDK, and Kyocera have gradually stopped some of their conventional product production capacity and switched to automotive electronics.

Due to the large demand in the automotive market, high prices, and better profits, major manufacturers have shifted their focus to the automotive field. In 2016, Japan's TDK cancelled 700 million orders for conventional MLCC products in 2017, covering about 360 models; Kyocera stopped production of 104 and 105 specifications for 0402 and 0603 sizes at the end of February 2018.

In April 2017, Apple's MLCC and R-Chip product supplier, the world's largest resistor manufacturer, and the world's third largest manufacturer of passive components, China Taiwan Guoju sent a letter to agents and customers announcing chip resistor R-CHIP and chips The price of capacitor MLCC is adjusted upward by 10%. In June of the same year, Yageo issued the second wave of price increase notices during the year. Starting from the third quarter, the price of MLCC increased by 15%-30%, and the delivery cycle was delayed by 1.5 to 6 months. Other manufacturers have also responded. Huaxin Technology, a large Taiwanese MLCC and R-CHIP manufacturer, notified customers and distributors that due to the increase in the prices of all raw materials in the second quarter of 2017, it adjusted the third-quarter contract prices. In the second half of 2018, trade friction between China and the United States continued to intensify, and demand for electronic terminals was frustrated. During the price increase period, distributors took the initiative to hoard stocks and speculate prices. All prices fell.

Reflecting the monthly output value and price data of Japanese manufacturers of MLCC, it basically fits the industry cycle. As a major global producer, it can be seen that the average price of MLCC in Japan is much higher than the domestic average (0.5 yen/unit equivalent to 31 yuan/1,000 The domestic average is about 8-13 yuan per thousand). And when the output decreases month-on-month, prices change significantly, reflecting the strong influence of leading manufacturers on prices.

(3) High-frequency data verify that supply and demand enter a tight balance

By observing the high-frequency data of Yageo and Huaxinke, it is found that after the industry downturn in 2019, the industry has gradually recovered. Due to the abnormal year-on-year value of Yageo's own Kimei consolidated in July, Huaxinke data also shows that downstream demand has recovered strongly.

From the perspective of inventory levels, the two major manufacturers are actively accumulating inventory. With reference to the past price increase cycle, manufacturers and distributors jointly stock up to promote price increases during the increase process. The current downstream demand is strong, and the major manufacturers may push prices up again. .

From Yageo's monthly review and outlook, entering 20H2, China's production capacity has recovered significantly after the impact of the epidemic. Although the utilization rate has continued to increase, the inventory level has always been at a low level. After 19 years of industry destocking, the inventory level in the industrial chain has been low. The epidemic has hit some overseas production capacity, and the recovery of supply lags behind demand. Therefore, we see that even if Yageo accelerates the increase in capacity utilization in Q3, the inventory level is always low. The reason is still strong terminal demand. The social isolation policy stimulates the demand for IT products, and the outbreak of 5G and new energy markets has created a structural demand boom. Huaxin Technology also mentioned in the December 2020 conference that the capacity utilization rate in Q3 has increased to 90%, and downstream demand has maintained good growth driven by 5G base stations, 5G mobile phones and laptops. We are concerned that the inventory levels of the two representative Taiwanese factories of Yageo and Huaxinke increased slightly last year. Considering that the capacity utilization rate has been at a historical high, the demand-side industry trend is still the same, the 5G mobile phone AIOT market is still in a rapid penetration stage, and new energy The auto industry is ushering in a period of rapid growth, and under the situation of tight supply and demand, MLCC prices are expected to enter a new round of price increase cycles.

Capacity strategy under the game pattern: small plant production capacity cannot affect prices, adopt full production price follow strategy. From the global MLCC market share, Murata and Samsung Electric have a relatively high absolute share, mainly occupying the high-end market, especially Murata starting from 2016 After withdrawing from the low-end market, Yageo has become a leading company in the low-end market, and has strong control over the supply of the industry. However, Huaxinke and the domestic Fenghua Third Ring still have a large gap in volume compared with Yageo. Small factories cannot affect effective supply by controlling capacity utilization. From the past history of MLCC, low economic conditions can still achieve profitability, and there is no loss and production reduction. Circumstances, therefore, from the perspective of the optimal strategy, small factories will inevitably choose a high utilization rate at a given price to grab the share at a price slightly lower than that of large factories. For large manufacturers, by controlling the utilization rate of capacity to affect the supply and demand situation of the industry, which in turn affects prices, it is possible to reduce production and increase profits.

We deduced that this round of MLCC prices has not yet seen a significant increase, mainly due to the gradual changes in the industry's competitive landscape. The huge price increase in 18 years disrupted the purchase plans of downstream customers. The price jump and shortage of goods damaged some customer relationships, and promoted domestic major customers to accelerate support for local manufacturers. Fenghua Sanhuan started to invest in new production capacity in 18 years and 20 years. The share of domestic manufacturers has increased significantly. In the process of ramping up the production capacity of small factories, the marginal gains of large factories actively reducing the utilization rate are insufficient. As the capacity utilization rate of major manufacturers is approaching high, the overseas epidemic situation intensifies in the winter and some production capacity is affected. We believe The strong support on the demand side is expected to promote a wave of price increases for MLCC. The main production capacity of large overseas factories has been completed in the second half of 20. The new domestic production capacity of Fenghua with a large expansion will be mainly released in 21 years. Therefore, the supply side increase in 21 years is limited and price increases may occur in a demand boom.

5. Comparison of company development paths under high-quality tracks

From the perspective of the industrial chain, although the MLCC's own industrial chain is relatively short, it involves more technical categories, covering new material technology, special equipment technology, design and production process, etc., especially the raw material link, involving a large amount of basic scientific research and development. Under the ten-year industrial chain division model, Japanese and Korean manufacturers have leading advantages in core material technology (ceramic formulations, powder production, slurry research and development), media stack printing technology, and co-firing technology. Technological progress is rapid, and partial replacement can be achieved in the production of low-end models.

Observing the competitive landscape of the MLCC industry, the characteristics of the echelon of manufacturers are obvious. With the announcement of the withdrawal of low-end models by Japanese manufacturers such as Murata TDK and the focus on car-level products, the product structure has been significantly different from other manufacturers. The first echelon camp is mainly Japanese and Korean companies, among which Japanese companies have accumulated a long time in upstream materials and equipment links, and invested heavily in R&D, forming a technical closed loop. From the most basic raw material formula production to self-developed equipment, the product production processes are all independent R&D iteration. Knowhow experience is the core barrier in the production process. MLCC has a long technical iteration cycle and historical technology has a strong accumulation effect. Therefore, the leading advantages of leading companies are preserved, and Japanese companies' emphasis on technological secrecy and the lifetime employment system make it difficult for outside factories to overtake through digging corners.

Samsung Electro-Mechanics, which is also the first echelon, has the second largest market share in the world, mainly due to Samsung's backing, and the initial establishment of Samsung's electronic terminal business. With Samsung's rise and gradually becoming a global giant, upstream materials still need to be purchased from Japan and South Korea.

The second-tier manufacturers are mainly Taiwanese, which have gradually developed and grown following the shift of the electronics industry chain. Taiwan's electronics industry has outstanding specialization and division of labor. With its deep distributor channels, it firmly occupied the share of small and medium-sized manufacturers, and when the Japanese withdrew from the low-end market Proactively consolidate low-end market share.

The third tier is mainly mainland brands. The most representative ones are Fenghua, Yuyang, Sanhuan, and Microcapacity. Among them, Fenghua currently has a monthly production capacity of 21 billion units, which is the largest in China. Yuyang has a monthly production capacity of about 16 billion units. Among them, the small size 0201 and 01005 account for a relatively high proportion. They are the leading small-size MLCCs in China. Sanhuan currently has a monthly production capacity of 10 billion pieces and mainly produces large-size products.

From the perspective of development model, MLCC head manufacturers mainly follow an integrated model, forming a closed loop from raw material preparation to equipment development. Basic science progresses slowly. To meet the needs of new electronic components, R&D work needs to start from basic materials, and accumulation of technical experience is crucial. important.

From downstream to upstream, the industry scale of market segments is gradually shrinking, and the effect of technical barriers is more prominent. Latecomers need to invest huge resources to achieve overtake, but the actual benefit space is small. Therefore, under the market mechanism, the market-oriented mechanism will compete in segments with high technical barriers. The pattern is more stable. Judging from the current market development and competitive landscape, Japanese companies focus on higher-value automotive-grade products with higher competition barriers, which are in line with the current growth point of downstream demand, and the industry's competitive position has been strengthened. From the perspective of cost price competition, self-made raw materials have a significant impact on the cost side of manufacturers. Taking domestic manufacturers as an example, their announcement disclosed that the gross profit margin of Tricyclic MLCC in 2019 was as high as 52.08%, and the gross profit margin of Fenghua MLCC was 39.61%. Refer to upstream material supplier countries. The gross profit margin of porcelain materials is about 45%-50%. Considering that the cost of raw materials in MLCC accounts for about 35-45%, self-supplied materials can bring theoretical profit margins of 15-20%. Even considering the small scale advantage of self-made and some raw materials are still Outsourcing is required, and the overall profit margin still has room for improvement of more than 10%. We can see that Sanhuan has accumulated a lot in upstream electronic ceramic materials, and its gross profit margin of electronic ceramic components is much higher than the industry average.

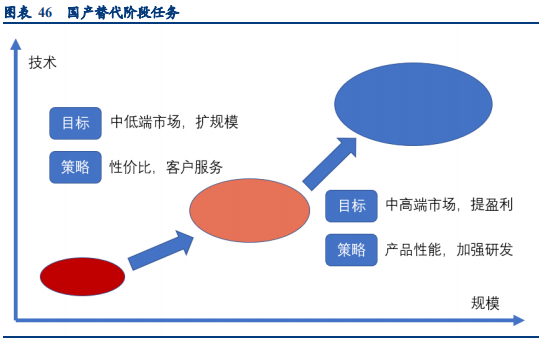

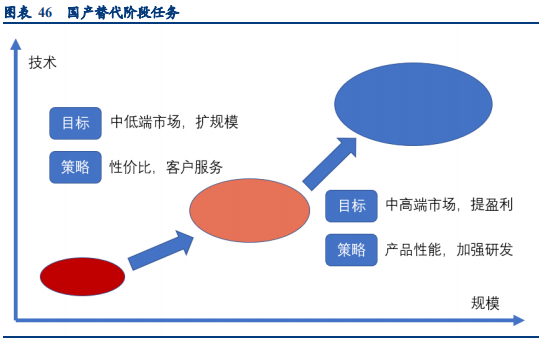

The main contradiction at different stages: In the early stage of domestic substitution in the low-end market, capacity expansion is the most important.

For domestic companies, breakthroughs in upstream raw materials are not only for increasing profitability, but also for supply chain security considerations. Global trade frictions continue and scientific and technological disputes are frequent. To achieve a real domestic substitution, it is not only necessary to break through the production process in the product link, but also to cultivate local suppliers in the raw material link to avoid the risk of high-end material supply interruption.

As far as the current development status of MLCC in China is concerned, the comprehensive share accounts for less than 5% of the world, and the self-sufficiency rate of low-end models is insufficient. Therefore, the main goal of domestic substitution is still in the first stage. The main task of this stage is to expand production capacity and accelerate customers. Introduced to achieve an increase in the market share of the low-end market, and strive to become the second echelon.

From the perspective of 2-3 years, Fenghua Hi-Tech's production capacity is the most flexible. As a leading domestic company, Fenghua Hi-Tech has the fastest capacity expansion in this round and the largest capacity under construction. It is progressing smoothly in the introduction of downstream customers and has good growth certainty. At the same time, Fenghua is also actively deploying upstream raw materials, achieving self-supply of some powders through its subsidiary Guohua New Materials.

From a five-year perspective, the integrated layout of Sanhuan has great potential for development. The domestic MLCC replacement space is still huge, especially the rapid growth of the new energy vehicle market, the domestic automotive electronics demand space is large, the automotive-grade MLCC market has a broad prospect, domestic manufacturers still have huge development potential, and the basic material breakthrough is domestic and Japanese manufacturers The key element of competition is that Sanhuan Group has accumulated a lot in basic materials. The company has focused on electronic ceramics for decades and is expected to enter the first-line echelon with its integrated layout.

VI. Analysis of related companies (see the original report for details)

Sanhuan Group: 50 years of accumulation has created the leading electronic ceramics, focusing on MLCC to open up room for growth.

Fenghua Hi-Tech: Growth and cycle resonate, and the leader of MLCC ushered in a new era.

Risk warning: technology research and development are not as expected, production expansion is not as expected, and downstream demand is less than expected.

(This article is for reference only and does not represent any of our investment advice. For relevant information, please refer to the original report.)

Selected report source: 【Future Think Tank Official Website】.

SMD Component Dipping Carrier Plate Manufacturer

SMD Component Dipping Carrier Plate Manufacturer